Finance

“Strategic Financial Planning: Aligning Goals for Sustainable Growth”

Financial Strategy Overview

so representing Finance today amongst the strategy practitioners um we just heard Salman on budgeting and before that Samir uh alignment with corporate and business strategic priorities some of the key assumptions that we use in Strategic Financial Planning assumptions uh the uh the criteria very important criteria for resource allocation uh to the Strategic priorities how do you actually select uh these strategic priorities uh what are the key resources that we invest in uh touching upon risk management ring fencing of resources for strategic projects and also uh tracking spend versus outcome and um little bit about the uh the fiveyear plan the the financial statements that we use statement the balance sheet and um um and the cash flow which is very important so let’s um and I’ll also share uh some of my experiences um at Uni and noades as to how they are doing their strategic plan.

Understanding Strategic Financial Processes

okay so um what’s the uh what is Strategic Financial Planning process so it is all about it’s a comprehensive process that uh achieves the long-term business objectives and financial goals it is a dynamic and on ongoing process and involves uh making decisions across all steps of strategy management it used to be in in in olden days it used to be uh the strategy document would be revised uh every two years at un but nowadays with the world changing so fast um most recently is that we have to do a ctly review of our Str plan this is this has put in a lot of pressure so unless we have the right systems uh and processes it’s going to be very cumbersome um so um any help like U for a good Strate strategy documentation system and Analysis system would be very helpful and I see that um through strategy has got a lot of facilities that one can explore.

Financial Analysis and Planning

so um so when doing financial analysis we have to look at companies current position we have to look at how the our financial plans align to the goals and objectives of the organization and also um in the introduction we have to talk about the allocation of resources to strategic priorities and manage business risk and Achieve long-term long-term Financial stability or sustainability is the keyword these days so coming to unber uh un is a fmcg company and it has a lot of broad range uh uh it’s a very big company uh one of the biggest fmcg company in the world um it has got a lot of categories like the personal care the Home Care the Beverages and food business so um the the strategic planning process starts with the categ plan as to and at the global level and this is cascaded down to Country level and region level uh then you have brand plans like Brands like Lux Dove sunsilk surf Lipton and brond these are Global Brands so each brand is supporting the category that they are in and then we have a business unit plan so this is like an over overarch it’s like uh for food business there will be a business unit head and for home and personal care there will be a business unit head so we have a country plan we have a region plan and we have a Global plan just like any other multinational company.

Insights from Leadership

some of the one of my uh boss uh a finance director from India actually came to visit Pakistan and then uh he gave this golden lesson to all the finance community that sales is Vanity meaning that Topline growth market share uh at any expense it’s it’s a vanity uh we all like to be number one and number two and that’s what y liever says also that the brands have to be number one and number two but then profit has to be sanity and ultimately cash is the reality so this is the under underlying principle for all finance that although uh Top Line is good uh but equally important is profit and ultimately companies that go bust is because they run out of cash so cash we have to manage so we will talk about the three statements that they are inte ated even in the fiveyear plan um previously it used to be only p&l or the income statement but nowadays it has to be an integrated uh balance sheet as well as cash flow to really understand uh how much is the capex requirement how much is the working capital requirement and whether we run out of cash or not.

Lessons from Unilever Strategic Financial Planning

so um this the second uh principle again learned from uni liver um my slide is not going yeah and this is very interesting you can get away with murder as long as your margins are right now this is very interesting the brand uh value or the intrinsic value of the brand depends upon the health of the brand and the health of the brand depends upon the margins of the brand if so the stronger the margins the stronger the brand it does depend whether the brand is it is in a luxury segment or it’s in everyday need segment um because the margin uh strategy will depend on the luxury will have luxury Brands will have a higher brand higher brand margins whereas a everyday item like a detergent powder um will have a much lower margin uh globally fmcg companies are trying to get away from uh low margin business business so uni lever has U Diversified their oil and da fat business uh they got out out of it and then they’re also got out of the loose tea brands um so theyve recently moved out of that so commodity business which are very volatile sometimes and they although very high volume it’s very low margin so they want to focus on a very high margin again um in my last in my one before the company I used to work at novat is a totally different company a pharmaceutical company um here the strategic planning process is very very different they look at the Glo Global disease burden study done by wh um they look at their own R&D pipeline they look at the global patient demographics um they look at U the reimbursement policy because it differs globally.

Strategic Planning Insights Strategic Financial Planning

so those which are insur insurance-based reimbursement like in us and uh and in Europe and the reimbursement policy actually um they launch their BRS first in those markets and then uh where self pay market like in subcontinent and in Pakistan Bangladesh and Sri Lanka countries uh where U you have to pay out of pocket uh these uh expensive brands are come in later uh so they have a global launch plan they do a a plan by therapeutic by disease area they do Planning by region and Country plans coming to the strategic planning and Analysis so in the strategy management cycle that we have been witnessing today starting from Mii um that we first look at the current situation we look at the U setting goals and objectives re formulate strategy we do strategic planning and go into the Strategic execution and then again the loop goes on so in each um area we have strategic Financial um planning is required so for example in looking at the current uh situation we look at the past past five year financial performance we look at the external and internal analysis like pestel do swort analysis and capability Gap analysis Etc so in every step the finances involved.

Resource Allocation and Risk Management

similarly when we are setting goals and objectives we want to evaluate uh new products and services we want to Benchmark uh Target setting for market share and also linked with that is uh profitability and liquidity so these are some of the financial objectives and business objectives that we need to set at this stage and financial uh evaluation and financial planning is required at this state also uh coming to the strategy formulation uh when we are looking at as making strategic choices we have to do project feasibility and along with the Strategic choices we have to look at the the HR strategy uh filling in the capability gaps supply chain strategy where we have to do capex for to meet certain gaps in manufacturing facility increasingly now we have to look at digital strategies so that our business model uh based on technology available and AIS of the world uh we have to uh account for that and then of course Finance strategy comes in and we try and make a a coh uh strategy map out of that and we’ve seen some examples strategy map today.

Execution and Monitoring

in terms of strategic planning these are both operational plans for individual functions as well as Financial plans which are both short-term medium-term long-term and involves resource allocation to the Strategic priorities uh then comes the strategy execution and we have talked about today is getting the right talent for the right position and um Finance resource and and allocating financial resources and uh looking at the and also make a balance score card to ensure that we are able to review um our progress in terms of strategy um execution so as you can see that uh throughout the uh strategy cycle uh the financial evaluation and financial planning and Analysis is a must and therefore uh companies like Jun L and other global companies have created a position called Finance business partners and these Finance business Parts actually report into uh the marketing or the business unit head and they are uh like many CFOs working for each business unit um and therefore Bridging the Gap between finance and marketing and um and also that Finance is able to have a better understanding of the business and its priorities and its customer pain points for example so they are able better able to do financial planning for their individual business units and when it comes to presenting it to corporate the the finance business partner is along with the business unit head is able to explain the strategy as well as the the Investments required in their business.

Case Study: Ice Cream Business in Pakistan

so for example in Pakistan when they launched the ice cream business walls one of the biggest uh growth driver was having ice cream freezers across the country and it was a huge investment so a phase wise investment uh plan was put in put in place um appointing distributor Network and um approximately 100,000 plus freezers were placed in the in the shops across uh the country and with each uh and they were monitoring the sales through both each ice cream cabinet and just to ensure that they productive okay um so the Strategic financial plan is not a plan in in in isolation it is actually a conference of all the organization strategy uh so as we see that starting with the the corporate strategy the marketing strategy sales strategy the supply chain strategy the R&D and Innovation Investments that we put the talent and the organization strategy they all are put uh take into account in when we are constructing a strategic financial plan.

Time Horizon and Financial Objectives

so um when we are looking at um a Time Horizon uh we looking at um we are looking at uh the operational budget the time Horizon is generally one year um then we are in the stage two we looking at one year plus some uh quot multiple for example in Rolling forecast we use um eight quarters rolling forecast so it is one year plus another four quarters um so this is also um more operational uh nature but when you come to two and two to three years U integrated financial planning um so there is an element of strategy uh in there where where you’re looking slightly longer term and when when you’re looking at 3 to 10 years it is uh incorporating all the Strategic priorities and strategic action that is required uh to take the organization to the to the vision uh and the mission the purpose of the organization so it is important that um we look at each um operational planning and the integrated strategic Financial Planning in in in its perspective the operational plan or the budget would be far more uh tactical and operational in nature whereas a 2 to three years or 3 to 10 years budget will have elements aligned with the Glo aligned with the corporate strategy.

Key Investments and Financial Analysis

so what are the key Investments That is required to uh execute those big uh changes or big transformation that is required has to be clearly articulated in those uh financial statements so uh when we are making doing financial analysis some of the basic questions that we ask is the current growth curve sustainable um so there is a growth curve uh we have to see whether uh we are in the growth path or we are we plateauing are we um declining so we need to uh understand the growth curve and it can be based on the life cycle of the brand uh when was it launched and so on um the other um questions are the profit margins that’s very important for the business viability and Business Health then we look at the uh the utilization of our the assets what kind of efficiency um these assets are being used at what kind of capacity utilization are we doing um if we are if if we are near capacity then we need to invest in further capacity expansion and similarly if we are underutilizing these assets then we must find ways and means to utilize these um under underuse capacity also uh we need to look at the operational cash flow um whe the business is able to create uh sufficient operating cash flow and there we need to balance our capex requirement as well as working capital and we may need to tweak uh the working capital policies so that um the investment in working capital is aligned with the liquidity requirements.

Working Capital Management

for example this inventory may be currently at 90 days uh so if you can cut it down to 60 days uh we are able to release a lot of cash uh same goes with customers terms and uh uh when the payable terms I remember that um in univa uh we were importing a lot of teas from Kenya and Indonesia and also Cal oil and I think uh the the term was 60 days uh one of our new commercial directors or Finance director came in and said the financing cost in uh internationally is much much lower and why can’t we increase the term Without Really affecting the cost um and he managed to we managed to from 60 days we managed to uh get the terms to 180 days and we had the we had a negative working capital which was fantastic because it gave us so much cash that we could invest in uh the ice cream business um in and actually we didn’t have to raise any capital or take any debt just a working capital um adjustment working Capital Management released cash so it’s very important for our uh team in the operations and in the sales and in procurement that should they should understand that the policy how they affect the working capital.

Life Cycle and Financial Analysis

also um we need when we are doing financial analysis we have to look through the life cycle uh whether we are in a startup phase where there is a huge investment in uh acquiring customers um and we may be in U negative at that moment um then we have the growth phase where we are expanding quickly uh and uh there’s a lot of investment required in both people and uh capacity and as well as working capital in maturity um there there we have to see how we manage and retain uh the profit uh manage the profitability um generally it’s a cash U driven business and therefore um we just have to manage the profitability of a mature business before we actually decide to diverse diversify.

Importance of Strategic Financial Planning

so um so why is strategic financial planning so important um and the the whole idea is that we want to achieve the Strategic goals and objectives we want to make informed decision making about Capital allocation and risk management we want to improve our financial performance and also we want to attract and retain investors this is very important when you are growing you need to retain investors you need to attract investors so that the business is able to raise Equity Capital as well as uh debt Capital so it’s quite important how we um sell the story the finance story uh to our investors then um also it’s all about risk management and mitigation as well as overall uh financial performance of the organization so this is uh why uh we want to do financial planning uh is to ensure that the business is sustainable it’s healthy and it’s able to generate cash to meet business expenses.

Key Assumptions in Financial Planning

some of the key assumptions that we use in financial planning are external indicators such as the economic growth rates the interest rate rates and inflation rates and um where the businesses dependent upon overseas customers as well as Imports and exchange rates play an important role uh the industry growth projections the competitive Dynamics as well as the internal capability gaps so these are some of the factors that you have to start building into your uh financial planning assumptions when you’re making it the core elements of Finance strategy is the capital structure as to what is the optimal mix of debt and Equity financing um debt is generally cheaper than Equity but then you can only uh take so much debt uh and the business acquires a mix of both debt and Equity um cost of capital is very important to understand what is the cost of raising capital from different sources.

Risk Management and Performance Measurement

uh Capital allocation and this is we are going to talk about uh shortly as to how we allocate uh or rank different projects for investment um for risk risk management is uh core in finance when we are doing financial planning we look at the various scenarios as to what’s the worst case what’s the best case and what’s the most likely case um then we look look at the performance measurement and these are uh some of the kpis that we use uh as discussed earlier um like sales growth and profit margin and cash generated so uh some of the financial objectives that we are uh concerned about when we are doing the financial planning are of course uh profitability we want to maximize the net income or earning per share uh or uh we Benchmark in the in the industry um what is the profitability Benchmark and then we try and at least uh exceed or meet uh that profitability Benchmark we want to look at the growth uh liquidity uh both efficiency and the solvency of the business long term.

Alignment withStrategic Financial Planning Priorities

alignment we’ve been talking about I think there was Alex actually talked about alignment a lot today and uh that is fundamental when we are doing financial planning uh it’s a fundamental that we align uh our financial budgets with corporate and business uh business strategic priorities and also um all the rest of the plans has to be aligned with the business strategic priorities so the sales HR R&D and are geographically expansion plans and all our operations plan first they need to be aligned with the Strategic priorities and then the financial plan that comes out also needs to not only at the highest level but also uh with individual functional plan um it has to align with that because each function would require different level of Investments for example HR needs to hire a team of uh new sales team for a new launch so we need need to take into account the additional headcount thereis.

Resource Allocation Criteria

in terms of uh uh resource allocation to for strategic priorities this is very very important and as to how we actually go about set choosing or ranking our articles our investment priorities and and how we choose those projects so as as discussed today there could be so many choices is there could be so many options and mihi today U showed a pallet of U the penta model whereby uh the options the Strategic choices were the were quite a huge number of strategic choices are open uh to to an organization so some of the uh allocation criteria is uh the Strategic alignment the return on investment and uh risk assessment uh we also look have to look at the time Horizon as to whether the project is shortterm or long term and also look whether um the project is flexible enough in terms of adapting resource allocation to the changing market conditions and priorities.

Project Evaluation Example Strategic Financial Planning

I’ll just show you an example that I did most recently um there were quite a few projects uh so I’ve just given them a code uh Project A B C D EF and the top part is the financial attractiveness and the second box at the bottom is the other non-financial uh factors so you can see that U we look at the initial cost uh we look at npv Net Present Value we look at the irr the

Finance

The One Financial Move That Can Change Everything: Build an Emergency Fund

Why an Emergency Fund Matters

If you want to worry less about your finances, build wealth, and avoid debt, it all starts with an Build an Emergency Fund. One of the lowest financial points anyone can experience is being unable to cover an unexpected expense—like a car repair—due to lack of savings. These situations are often a result of not planning ahead or failing to budget properly.

The Reality of Financial Ups and Downs

Even in months of high earnings, Build an Emergency Fund peace of mind comes from knowing that there’s a financial cushion to fall back on during low-income periods. An emergency fund is crucial for covering unexpected expenses like a broken boiler, roof repair, or job loss. Sometimes, more than one emergency can occur at once, making financial stress even more difficult if you’re living paycheck to paycheck.

The Cost of Ignoring It: Debt Trap

Without an emergency fund, a single unexpected cost can force you into debt. Add another emergency fund on top of that, and you could fall deeper into the cycle. Paying off debt, especially with high interest rates, only makes things harder. It’s a vicious cycle that holds you back financially—but there’s a way out.

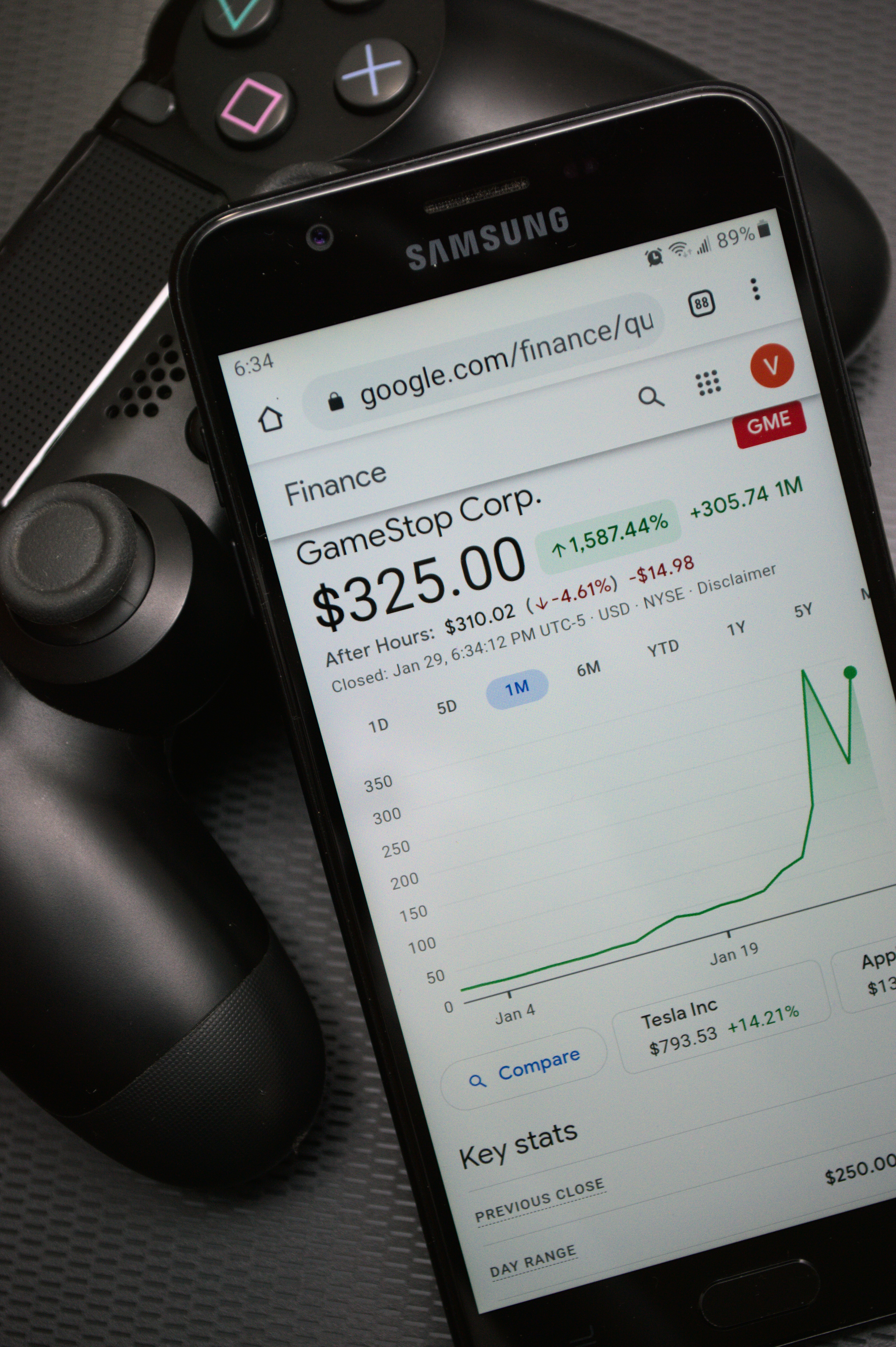

Why Emergency Funds Come Before Investments

Investing may seem more exciting, especially with social media trends encouraging immediate wealth building. But financial experts typically advise having an emergency fund before investing. Investments work best over time, and markets can have ups and downs. You don’t want to be forced to pull money out of your investments during a downturn just to cover an emergency. That’s why emergency funds are vital—they protect your investments by covering unexpected costs.

How Much Should Be in an Build an Emergency Fund?

Most financial experts recommend setting aside 3 to 6 months of essential expenses. For example, if your monthly essentials cost £2,500, you’ll want about £7,500 in your emergency fund. While that may seem like a lot, especially given that the average savings in the UK is only around $1,000, it’s important to remember that these figures vary. Nearly half of people have £1,000 or less in savings, so if you’re above that, you’re already ahead.

Adjusting Based on Your Lifestyle Build an Emergency Fund

This isn’t a one-size-fits-all approach. If your lifestyle is frugal, your car is reliable, and your housing costs are low, you might not need as large a fund. It helps to identify your own worst-case scenario—like losing your job—and base your fund size around that. Start small: aim for £1,000, then one month of expenses, and build from there.

When to Stop Contributing to the Build an Emergency Fund

There will come a point when your emergency fund is “full.” Keeping £100,000 in a low-interest savings account doesn’t make sense if you’re neglecting pensions or investments. Balance is key.

How to Build Your Emergency Fund

1. Break It Down into Steps Build an Emergency Fund

Set a target and timeframe. For example, to save £7,500 over 24 months, you’d need to save about £310 each month. If that’s not possible, start smaller but stay consistent.

2. Automate Your Savings Build an Emergency Fund

Make saving automatic. Set up a direct debit so the money goes into your emergency fund as soon as your income hits your account. Make it a non-negotiable part of your budget.

Important Note: If you have high-interest debt, like credit card debt, focus on paying that off first. No savings interest will outweigh the cost of that kind of debt.

3. Use Savings Challenges or Micro-Savings Apps

Savings challenges like the Penny Challenge or 100 Envelope Challenge can be fun ways to build savings gradually. Micro-savings apps (e.g., Plum) or banking app features that round up transactions and set the difference aside are also helpful tools to boost savings effortlessly.

Where to Keep Your Emergency Fund

Accessibility is Key Build an Emergency Fund

Your emergency fund needs to be easy to access. Avoid stashing it in accounts with withdrawal penalties or low interest. Look for an easy-access saver account that allows multiple withdrawals if needed and offers the best interest rate possible.

Consider Tiered Saving Accounts Build an Emergency Fund

If you have a larger fund—say over £5,000—you might want to split it: keep some in a very accessible account (even if interest is lower) and the rest in an account with better interest but limited withdrawals. Shop around for the best deals and be open to moving your money.

Build an Emergency Fund: The Foundation of Wealth Building

An emergency fund helps avoid debt and stress, but it’s your long-term savings, pensions, and investments that truly build wealth. Think of the emergency fund as your financial foundation. It protects your future gains and helps keep your financial goals on track.

Even if you can only invest £50 a month, over 20 years with a 6% return, you could end up with around £22,000. And it’s your emergency fund that ensures you can consistently save or invest that £50, no matter what life throws your way.

Finance

Emergency Fund Calculation: How Much Should You Really Save?

The easiest way to Emergency Fund Calculation is to not calculate at all and to rely on a couple of data points. The rule of thumb for emergencies is that you should have 3 to eight months of expenses saved away in an emergency fund. But where did we get here, and why have we been regurgitating that same advice for years? Many financial experts have repeated this advice, but it’s worth questioning its origins and whether it still applies today. For many years, we’ve heard that you need a large emergency fund, but it took some critical thinking to figure out where this information came from and whether it’s still relevant.

What Is an Emergency Fund?

An Emergency Fund Calculation is cash that you have in a savings account, preferably a high-yield savings account, that you can tap into in the event of an emergency. This is a crucial piece of financial security and stability because the idea is that if you have cash on hand and you have an emergency, you can pull that money out of the emergency fund. It prevents you from going into a deeper financial hole if you had no money in a savings account and had to rely on high-interest credit cards, personal loans, or borrowing from others.

The Purpose of an Emergency Fund Calculation

The idea is that an emergency fund provides both literal and emotional peace of mind, offering a financial safety net.

New Research on Emergency Fund Calculation Amounts

Some researchers, Jorge Saat and Emily Gallagher, have crunched the data to determine how much money people should be saving for emergencies. They found that the traditional advice of having 3 to 6 months of income set aside isn’t supported by data. Instead, they looked at lower-income individuals who are more likely to need an emergency fund and don’t have access to other resources.

What the Research Found Emergency Fund Calculation

Their research found that the amount needed to prevent an emergency from becoming a financial disaster is not as high as 3 to 6 months of expenses. In 2019, they found that $2,467 was the amount needed to prevent an emergency from turning into financial hardship. Additionally, once you hit $500 saved, each additional dollar you save increases the likelihood that you won’t fall into financial hardship in an emergency.

What This Means for You

This research gives us a more data-backed approach to saving for emergencies. Rather than aiming for 3 to 6 months of expenses, we now have a better benchmark to start with. Instead of thinking you need to save an overwhelming amount, you can aim for a more achievable starting goal.

Setting Realistic Emergency Fund Calculation Goals

In 2020, about a quarter of Americans had less than $400 available in case of an emergency. Therefore, setting a goal of $400 for your emergency fund is a good starting point. After reaching $400, you can work on building up to $1,000. This is more of a mental goal than anything rooted in data, but for many people, seeing four digits in their bank account helps them feel secure.

Inflation-Adjusted Amounts Emergency Fund Calculation

Once you’ve saved $1,000, it’s time to move toward the inflation-adjusted amount found in the research. The study was conducted in 2019, but considering inflation, the amount now is $2,970. This is a more realistic number to aim for in today’s financial landscape.

Building Your Emergency Fund Calculation in Tiers

After reaching these early benchmarks, it’s important to adjust the amount to match your personal situation. For example, if you look at your last three months of spending, you’ll get a better idea of what your real expenses are. From there, you can calculate the amount needed for a one-month emergency fund based on your essentials like rent, transportation, food, and medicine.

Calculating Your One-Month Emergency Fund Calculation

This amount could range from $3,000 to $10,000, depending on your circumstances.

Quick Reminders About Emergency Funds

Purpose and Use of Emergency Fund Calculation

A couple of quick reminders about emergencies: They are meant to be used in the event of an emergency and not for discretionary purchases like designer sales or a weekend getaway. Your emergency fund should be kept in a readily accessible place, ideally in an FDIC-insured high-yield savings account.

Where to Keep Your Emergency Fund Calculation

While checking accounts offer minimal interest, high-yield savings accounts currently offer interest rates between 4% and 5%, which means your money will grow even as you keep it accessible for emergencies. This emergency fund is not meant to be invested or used for long-term goals. It’s simply there to provide peace of mind and security in the event of a financial emergency.

Finance

Analysis of Nvidia Stock Price Chart: Trends and Insights

Introduction to Nvidia and Its Market Position

Nvidia Corporation, founded in 1993, has become a significant player in the semiconductor industry, particularly noted for its pioneering work in graphics processing units (GPUs). Originally targeting the nvidia stock price chart gaming market, Nvidia has expanded its innovations into various sectors, including artificial intelligence (AI), data centers, and automotive technology. Over the years, Nvidia has evolved from a focused graphics company to a diversified technology leader, driving advancements in parallel computing and deep learning, among other areas.

Historically, Nvidia’s stock performance has mirrored Nvidia stock price chart its substantial business achievements and technological breakthroughs. The company went public in 1999, and its stock price has seen remarkable growth, especially in the past decade. Key milestones, such as the introduction of the CUDA programming model and advancements in ray tracing technology, have solidified Nvidia’s dominance in the GPU market. The company’s strategic investments in AI technologies have further positioned it as a key resource in the evolving tech landscape, impacting sectors that range from gaming to complex scientific research.

Nvidia’s innovative trajectory is underscored by notable collaborations and acquisitions, which have expanded its capabilities and market reach. The acquisition of Mellanox Technologies in 2020, for instance, enhanced Nvidia’s data center business and allowed it to broaden its portfolio of high-performance computing solutions. This decisive move illustrates the company’s commitment to steering its growth through technology alignment and market demand. As a result, Nvidia continues to capture significant market share, resulting in impressive financial performance and positioning within the semiconductor ecosystem.

This overview sets the context for a deeper analysis of Nvidia’s stock price chart, where we will explore the trends and insights that have influenced its market valuation over the years.

Understanding the Nvidia stock price chart: Key Metrics and Indicators

The analysis of Nvidia’s stock price chart is essential for investors seeking to make informed decisions. Several key metrics and indicators can provide valuable insights. Firstly, the price-to-earnings (P/E) ratio is a critical metric. This ratio helps investors understand the valuation of Nvidia’s stock relative to its earnings. A higher P/E may indicate that the stock is overvalued, or alternatively, it may reflect strong market confidence in future growth.

Another important element is the market capitalization, which provides a comprehensive view of Nvidia’s total value as a publicly traded entity. By multiplying the current stock price by the total number of outstanding shares, market capitalization facilitates comparison with competitors and identifies Nvidia’s position within the technology sector.

Moreover, trading volume is a crucial indicator that shows the number of shares traded within a specific timeframe. Increased trading volume often signals heightened investor interest, which can impact stock price movements. For instance, abnormal spikes in trading volume may indicate that significant news has prompted a re-evaluation of the stock, making it a notable point of analysis.

In addition to fundamental metrics, technical indicators play a significant role in stock analysis. The moving averages smooth out price data over a specific period, thereby helping to identify trends. A common strategy involves observing the crossover of short-term and long-term moving averages to signal potential buy or sell opportunities.

The Relative Strength Index (RSI) is another technical indicator that measures the speed and change of price movements, typically ranging from 0 to 100. An RSI above 70 suggests that the stock may be overbought, whereas an RSI below 30 indicates it may be oversold, giving investors insight into potential entry or exit points. Lastly, the Moving Average Convergence Divergence (MACD) helps determine momentum and trend direction, offering further guidance on possible trading actions.

Historical Trends in Nvidia stock price chart: A Detailed Analysis

Nvidia Corporation, a leader in graphical processing units (GPUs) and artificial intelligence technology, has undergone significant fluctuations in its stock price since its initial public offering in 1999. Analyzing the historical trends of Nvidia’s stock reveals the influence of various factors, including product innovations, earning performance, and broader market dynamics.

In the early years, Nvidia’s stock price was relatively stable, with modest gains resulting from steady product releases aimed at both consumers and professionals. However, a notable transformation occurred in the mid-2010s when demand surged due to the rise of gaming and cryptocurrency mining. This phenomenon contributed to a sharp increase in Nvidia’s stock as the company capitalized on its industry-leading technology, leading to a peak market valuation.

Key product launches have played a critical role in shaping the stock price trajectory. The introduction of the Pascal architecture in 2016 marked a milestone, significantly enhancing performance and driving sales across various segments. Subsequent releases, like the Turing architecture, captured market attention, further propelling stock prices. Additionally, Nvidia’s strategic moves into artificial intelligence and data centers have highlighted its adaptability and potential for long-term growth, positively influencing investor sentiment.

Earnings reports have also been crucial in affecting Nvidia’s stock trends, often resulting in volatility. For instance, in Q2 2021, robust earnings and optimistic guidance led to an unprecedented spike in stock prices. Conversely, unexpected results or cautious forecasts can lead to rapid declines. Furthermore, external factors, such as shifts in market sentiment and economic conditions, have driven fluctuations, illustrating the stock’s volatility.

Overall, Nvidia’s stock history presents a compelling case study of how innovation, market trends, and external factors converge to drive performance, underscoring the importance of comprehensive analysis for investors looking to engage with this dynamic stock.

Future Outlook for Nvidia’s Stock: Analyst Predictions and Market Sentiment

The future outlook for Nvidia’s stock appears to be influenced by multiple factors, including technological advancements, competitive pressures, and macroeconomic conditions. Analysts have been bullish on Nvidia’s capacity to harness growth in areas such as artificial intelligence (AI) and gaming, which are pivotal to its growth strategy. With AI applications gaining traction across industries, Nvidia’s GPUs play a critical role, propelling expectations for expansive revenue streams. According to several analysts, this strong growth avenue could significantly bolster Nvidia’s stock price in the coming quarters.

Moreover, advancements in gaming technology, particularly with the emergence of next-generation consoles and graphics performance enhancements, position Nvidia as a leading player in this segment. The company’s commitment to innovation and its continued development of cutting-edge graphics cards could resonate positively with investors, reinforcing confidence in the stock’s potential. Analysts forecast a favorable trajectory if Nvidia maintains its competitive edge and expands its market share in the gaming industry.

However, potential challenges exist that could affect stock performance. Increased competition from companies like AMD and Intel presents a dynamic environment that may pressure Nvidia’s pricing strategies, potentially affecting margins. Additionally, the volatility surrounding semiconductor supply chains and geopolitical tensions adds a layer of uncertainty that analysts are closely monitoring. Recent headlines regarding tech regulations and trade relations can also cultivate caution among investors.

Market sentiment has shown resilience, with investors largely optimistic about Nvidia’s future proving evident from recent trading patterns. Overall, while the outlook for Nvidia’s stock remains promising with robust opportunities in AI and gaming, stakeholders should stay vigilant regarding market dynamics and competitive factors that might influence performance. As both analysts’ predictions and market sentiment evolve, a comprehensive analysis is essential for those evaluating Nvidia’s stock potential moving forward.

-

Finance2 months ago

Finance2 months agoThe Importance of Business Card Holders: A Comprehensive Guide

-

Finance2 months ago

Finance2 months agoUnderstanding Apple Business Manager: A Comprehensive Guide

-

Finance2 months ago

Finance2 months agoUnderstanding the Business for Sale Market: A Comprehensive Guide

-

Finance2 months ago

Finance2 months agoThe Evolution of Office Depot Business: A Comprehensive Overview

-

Online Games Platform2 months ago

Online Games Platform2 months agoExploring the World of Go Game Online: A Comprehensive Guide

-

Finance2 months ago

Finance2 months agoThe Whiskey Business: An In-Depth Exploration of a Timeless Industry

-

Online Games Platform2 months ago

Online Games Platform2 months agoThe World’s Hardest Game: An In-Depth Analysis

-

Tech2 months ago

Tech2 months agoSurgical Tech Salary: A Comprehensive Overview