Finance

Finding the Perfect Business Locations for Rent

Introduction

Choosing the right location for your business is one of the most critical decisions you will make as an entrepreneur. A well-chosen location can enhance visibility, attract customers, and create a conducive environment for employees. In contrast, a poor location can lead to wasted resources, limited growth, and ultimately, business failure. This comprehensive guide explores various types of business locations for rent, factors to consider, and practical tips for securing the ideal space for your needs.

1. Types of Business Locations for Rent

When looking for business locations for rent, it’s essential to understand the different types available. Each type of location has its own advantages and caters to specific business needs.

1.1 Retail Spaces

Retail spaces are designed for businesses that sell products directly to consumers. These locations are typically situated in high-traffic areas, such as shopping malls, downtown districts, or major streets. Retail spaces can vary in size, from small kiosks to large storefronts.

Advantages:

- High visibility and foot traffic can lead to increased sales.

- Proximity to competitors can create a shopping destination.

Considerations:

- Evaluate the demographics of the area to ensure it aligns with your target market.

- Analyze foot traffic patterns at different times of the day to determine the best hours for operation.

1.2 Office Spaces

Office spaces are crucial for businesses that rely on administrative work, meetings, and client interactions. These spaces can range from co-working environments to dedicated offices in high-rise buildings.

Advantages:

- Professional environments enhance client perceptions and employee morale.

- Options for shared amenities can reduce costs.

Considerations:

- Assess the layout and how it supports your team’s workflow.

- Check for necessary amenities such as high-speed internet, conference rooms, and kitchen facilities.

1.3 Industrial Spaces

Industrial spaces are ideal for manufacturing, warehousing, or distribution businesses. These locations are typically on the outskirts of urban areas, providing ample space for large machinery and inventory.

Advantages:

- Generally lower rental costs compared to urban retail or office spaces.

- Ample space for inventory and equipment.

Considerations:

- Ensure adequate transportation access for supply chain efficiency.

- Check zoning regulations to confirm that your intended use is permitted.

1.4 Flex Spaces

Flex spaces combine features of both office and industrial spaces, making them suitable for diverse business needs. They can be customized for various purposes, such as showrooms, offices, or light manufacturing.

Advantages:

- Flexibility to adapt the space as your business needs change.

- Potential for lower rental costs compared to specialized spaces.

Considerations:

- Ensure the layout can accommodate different business functions.

- Verify that the space meets local building codes and safety regulations.

1.5 Virtual Offices

Virtual offices provide businesses with a professional address and access to essential services without the need for physical office space. This option is ideal for startups and remote workers who need a business presence without the overhead costs of a traditional office.

Advantages:

- Cost-effective solution for businesses that do not require a full-time physical office.

- Access to professional services such as mail handling and call answering.

Considerations:

- Evaluate the credibility of the virtual office provider.

- Ensure that the services offered align with your business needs.

2. Factors to Consider When Business Locations for Rent

Selecting a business location involves careful consideration of various factors. Understanding these elements can help you make an informed decision that supports your business goals.

2.1 Location and Accessibility

The location of your business is paramount. A prime location can attract more customers and clients, while a poorly located business may struggle to gain visibility.

Key Points:

- Proximity to your target market: Ensure your business is located where your customers are.

- Accessibility: Consider transportation options for both employees and customers. Easy access to public transport and major roads is a plus.

- Competition: Analyze the presence of competitors in the area. While competition can indicate demand, too many similar businesses in close proximity can dilute your market share.

2.2 Cost

Budget is a significant factor when considering rental locations. Rent prices can vary greatly depending on location, size, and type of space.

Key Points:

- Determine your budget: Establish a clear rental budget that includes all associated costs, such as utilities and maintenance.

- Analyze the cost per square foot: Compare rental costs between different locations to ensure you’re getting value for your money.

- Consider future costs: Account for potential rent increases and additional expenses as your business grows.

2.3 Lease Terms

Understanding the lease terms is crucial before signing any rental agreement. Common lease types include:

- Gross Lease: The landlord covers all expenses, including taxes and maintenance. This can simplify budgeting but may result in higher base rent.

- Net Lease: The tenant pays a lower base rent plus a portion of the property expenses, such as property taxes and insurance.

- Percentage Lease: Common in retail, where the tenant pays a base rent plus a percentage of sales, aligning landlord and tenant interests.

Key Points:

- Review lease terms carefully: Pay attention to renewal options, termination clauses, and any additional fees.

- Negotiate terms: Don’t hesitate to ask for favorable terms, especially if you have leverage due to the current market conditions.

2.4 Space Requirements

Assess your business’s current and future space needs. Consider not only the size of the physical space but also how it will accommodate growth.

Key Points:

- Current needs: Calculate the amount of space required for employees, equipment, and inventory.

- Future growth: Plan for potential expansion. Is there room to grow within the same space, or will you need to relocate in the future?

2.5 Amenities and Services

Different business locations offer varying amenities that can enhance your operations. Consider what features are important, such as:

- High-speed internet: Essential for most businesses today.

- Meeting rooms: Important for businesses that require client interactions or team meetings.

- Parking facilities: Ensure there is adequate parking for employees and customers.

- Security systems: Evaluate the safety of the area and the security measures in place.

3. Tips for Securing the Best Business Locations for Rent

Finding the right business location is a process that requires diligent research and careful consideration. Here are some tips to help you secure the best location for your business.

3.1 Research the Market

Conduct thorough research on the local real estate market. Understanding rental trends, average prices, and available properties will give you a better idea of what to expect.

Key Points:

- Utilize online platforms: Websites like LoopNet, Zillow, and local real estate listings can provide insights into available properties.

- Attend local business events: Networking with other business owners can provide valuable information about the local market.

3.2 Work with a Real Estate Agent

A knowledgeable real estate agent can provide valuable insights into the rental market. They can help you identify suitable locations, negotiate lease terms, and navigate any legal complexities.

Key Points:

- Choose an agent with experience in commercial real estate: Their expertise can save you time and money.

- Communicate your needs clearly: Make sure your agent understands your business requirements and budget constraints.

3.3 Visit Multiple Locations

Don’t settle for the first location you find. Visit multiple properties to compare options and evaluate their suitability.

Key Points:

- Pay attention to the surrounding area: Consider the neighborhood’s vibe and how it aligns with your brand.

- Observe the condition of the property: Look for any necessary repairs or renovations that could impact your decision.

3.4 Negotiate Terms

Don’t hesitate to negotiate lease terms with the landlord. Depending on the market conditions, you may be able to secure lower rent, better lease terms, or additional amenities.

Key Points:

- Be prepared to advocate for your business’s needs: This could include rent reductions, longer lease terms, or improvements to the space.

- Get everything in writing: Ensure that any negotiated terms are documented in the lease agreement.

3.5 Consider Future Growth

When selecting a location, think long-term. Will the space accommodate your business as it grows?

Key Points:

- Plan for scalability: Look for properties that can be easily expanded or modified as your business evolves.

- Evaluate the potential for subleasing: If you anticipate needing more space in the future, consider locations that allow for subleasing additional areas.

3.6 Check Local Regulations

Ensure that the space you choose complies with local zoning laws and regulations. Some areas may have restrictions on the types of businesses that can operate there.

Key Points:

- Consult with local authorities: Verify that your intended use for the property is permissible.

- Investigate any permits or licenses required: Ensure you have all necessary documentation to operate legally.

4. Conclusion

Finding the right business location for rent is a critical step in establishing and growing your business. By understanding the various types of spaces available, evaluating essential factors, and following practical tips, you can make informed decisions that set your business up for success.

Key Takeaways

- Research Thoroughly: Conduct market research to understand rental trends and property availability.

- Evaluate Your Needs: Assess both current and future space requirements to ensure your chosen location supports growth.

- Negotiate Wisely: Don’t shy away from negotiating lease terms that align with your business goals.

- Consider Local Regulations: Ensure compliance with zoning laws and business licenses to avoid future complications.

Whether you’re looking for a vibrant retail space, a functional office, or a flexible industrial space, the right location can provide the foundation for your business’s growth and prosperity. Take your time, conduct thorough research, and don’t hesitate to seek professional assistance to secure the best deal. Your business’s success may depend on it.

Finance

The One Financial Move That Can Change Everything: Build an Emergency Fund

Why an Emergency Fund Matters

If you want to worry less about your finances, build wealth, and avoid debt, it all starts with an Build an Emergency Fund. One of the lowest financial points anyone can experience is being unable to cover an unexpected expense—like a car repair—due to lack of savings. These situations are often a result of not planning ahead or failing to budget properly.

The Reality of Financial Ups and Downs

Even in months of high earnings, Build an Emergency Fund peace of mind comes from knowing that there’s a financial cushion to fall back on during low-income periods. An emergency fund is crucial for covering unexpected expenses like a broken boiler, roof repair, or job loss. Sometimes, more than one emergency can occur at once, making financial stress even more difficult if you’re living paycheck to paycheck.

The Cost of Ignoring It: Debt Trap

Without an emergency fund, a single unexpected cost can force you into debt. Add another emergency fund on top of that, and you could fall deeper into the cycle. Paying off debt, especially with high interest rates, only makes things harder. It’s a vicious cycle that holds you back financially—but there’s a way out.

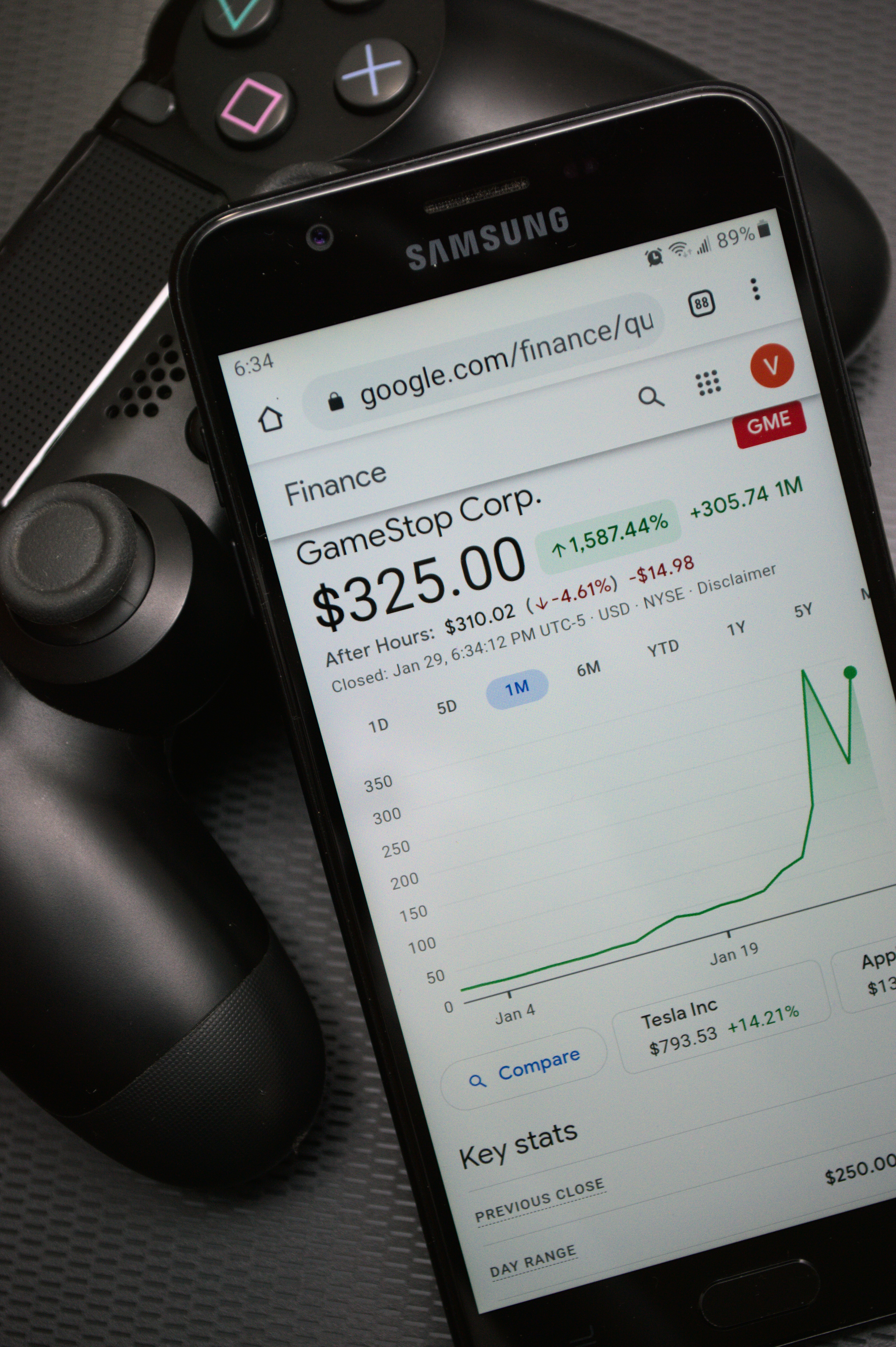

Why Emergency Funds Come Before Investments

Investing may seem more exciting, especially with social media trends encouraging immediate wealth building. But financial experts typically advise having an emergency fund before investing. Investments work best over time, and markets can have ups and downs. You don’t want to be forced to pull money out of your investments during a downturn just to cover an emergency. That’s why emergency funds are vital—they protect your investments by covering unexpected costs.

How Much Should Be in an Build an Emergency Fund?

Most financial experts recommend setting aside 3 to 6 months of essential expenses. For example, if your monthly essentials cost £2,500, you’ll want about £7,500 in your emergency fund. While that may seem like a lot, especially given that the average savings in the UK is only around $1,000, it’s important to remember that these figures vary. Nearly half of people have £1,000 or less in savings, so if you’re above that, you’re already ahead.

Adjusting Based on Your Lifestyle Build an Emergency Fund

This isn’t a one-size-fits-all approach. If your lifestyle is frugal, your car is reliable, and your housing costs are low, you might not need as large a fund. It helps to identify your own worst-case scenario—like losing your job—and base your fund size around that. Start small: aim for £1,000, then one month of expenses, and build from there.

When to Stop Contributing to the Build an Emergency Fund

There will come a point when your emergency fund is “full.” Keeping £100,000 in a low-interest savings account doesn’t make sense if you’re neglecting pensions or investments. Balance is key.

How to Build Your Emergency Fund

1. Break It Down into Steps Build an Emergency Fund

Set a target and timeframe. For example, to save £7,500 over 24 months, you’d need to save about £310 each month. If that’s not possible, start smaller but stay consistent.

2. Automate Your Savings Build an Emergency Fund

Make saving automatic. Set up a direct debit so the money goes into your emergency fund as soon as your income hits your account. Make it a non-negotiable part of your budget.

Important Note: If you have high-interest debt, like credit card debt, focus on paying that off first. No savings interest will outweigh the cost of that kind of debt.

3. Use Savings Challenges or Micro-Savings Apps

Savings challenges like the Penny Challenge or 100 Envelope Challenge can be fun ways to build savings gradually. Micro-savings apps (e.g., Plum) or banking app features that round up transactions and set the difference aside are also helpful tools to boost savings effortlessly.

Where to Keep Your Emergency Fund

Accessibility is Key Build an Emergency Fund

Your emergency fund needs to be easy to access. Avoid stashing it in accounts with withdrawal penalties or low interest. Look for an easy-access saver account that allows multiple withdrawals if needed and offers the best interest rate possible.

Consider Tiered Saving Accounts Build an Emergency Fund

If you have a larger fund—say over £5,000—you might want to split it: keep some in a very accessible account (even if interest is lower) and the rest in an account with better interest but limited withdrawals. Shop around for the best deals and be open to moving your money.

Build an Emergency Fund: The Foundation of Wealth Building

An emergency fund helps avoid debt and stress, but it’s your long-term savings, pensions, and investments that truly build wealth. Think of the emergency fund as your financial foundation. It protects your future gains and helps keep your financial goals on track.

Even if you can only invest £50 a month, over 20 years with a 6% return, you could end up with around £22,000. And it’s your emergency fund that ensures you can consistently save or invest that £50, no matter what life throws your way.

Finance

Emergency Fund Calculation: How Much Should You Really Save?

The easiest way to Emergency Fund Calculation is to not calculate at all and to rely on a couple of data points. The rule of thumb for emergencies is that you should have 3 to eight months of expenses saved away in an emergency fund. But where did we get here, and why have we been regurgitating that same advice for years? Many financial experts have repeated this advice, but it’s worth questioning its origins and whether it still applies today. For many years, we’ve heard that you need a large emergency fund, but it took some critical thinking to figure out where this information came from and whether it’s still relevant.

What Is an Emergency Fund?

An Emergency Fund Calculation is cash that you have in a savings account, preferably a high-yield savings account, that you can tap into in the event of an emergency. This is a crucial piece of financial security and stability because the idea is that if you have cash on hand and you have an emergency, you can pull that money out of the emergency fund. It prevents you from going into a deeper financial hole if you had no money in a savings account and had to rely on high-interest credit cards, personal loans, or borrowing from others.

The Purpose of an Emergency Fund Calculation

The idea is that an emergency fund provides both literal and emotional peace of mind, offering a financial safety net.

New Research on Emergency Fund Calculation Amounts

Some researchers, Jorge Saat and Emily Gallagher, have crunched the data to determine how much money people should be saving for emergencies. They found that the traditional advice of having 3 to 6 months of income set aside isn’t supported by data. Instead, they looked at lower-income individuals who are more likely to need an emergency fund and don’t have access to other resources.

What the Research Found Emergency Fund Calculation

Their research found that the amount needed to prevent an emergency from becoming a financial disaster is not as high as 3 to 6 months of expenses. In 2019, they found that $2,467 was the amount needed to prevent an emergency from turning into financial hardship. Additionally, once you hit $500 saved, each additional dollar you save increases the likelihood that you won’t fall into financial hardship in an emergency.

What This Means for You

This research gives us a more data-backed approach to saving for emergencies. Rather than aiming for 3 to 6 months of expenses, we now have a better benchmark to start with. Instead of thinking you need to save an overwhelming amount, you can aim for a more achievable starting goal.

Setting Realistic Emergency Fund Calculation Goals

In 2020, about a quarter of Americans had less than $400 available in case of an emergency. Therefore, setting a goal of $400 for your emergency fund is a good starting point. After reaching $400, you can work on building up to $1,000. This is more of a mental goal than anything rooted in data, but for many people, seeing four digits in their bank account helps them feel secure.

Inflation-Adjusted Amounts Emergency Fund Calculation

Once you’ve saved $1,000, it’s time to move toward the inflation-adjusted amount found in the research. The study was conducted in 2019, but considering inflation, the amount now is $2,970. This is a more realistic number to aim for in today’s financial landscape.

Building Your Emergency Fund Calculation in Tiers

After reaching these early benchmarks, it’s important to adjust the amount to match your personal situation. For example, if you look at your last three months of spending, you’ll get a better idea of what your real expenses are. From there, you can calculate the amount needed for a one-month emergency fund based on your essentials like rent, transportation, food, and medicine.

Calculating Your One-Month Emergency Fund Calculation

This amount could range from $3,000 to $10,000, depending on your circumstances.

Quick Reminders About Emergency Funds

Purpose and Use of Emergency Fund Calculation

A couple of quick reminders about emergencies: They are meant to be used in the event of an emergency and not for discretionary purchases like designer sales or a weekend getaway. Your emergency fund should be kept in a readily accessible place, ideally in an FDIC-insured high-yield savings account.

Where to Keep Your Emergency Fund Calculation

While checking accounts offer minimal interest, high-yield savings accounts currently offer interest rates between 4% and 5%, which means your money will grow even as you keep it accessible for emergencies. This emergency fund is not meant to be invested or used for long-term goals. It’s simply there to provide peace of mind and security in the event of a financial emergency.

Finance

Analysis of Nvidia Stock Price Chart: Trends and Insights

Introduction to Nvidia and Its Market Position

Nvidia Corporation, founded in 1993, has become a significant player in the semiconductor industry, particularly noted for its pioneering work in graphics processing units (GPUs). Originally targeting the nvidia stock price chart gaming market, Nvidia has expanded its innovations into various sectors, including artificial intelligence (AI), data centers, and automotive technology. Over the years, Nvidia has evolved from a focused graphics company to a diversified technology leader, driving advancements in parallel computing and deep learning, among other areas.

Historically, Nvidia’s stock performance has mirrored Nvidia stock price chart its substantial business achievements and technological breakthroughs. The company went public in 1999, and its stock price has seen remarkable growth, especially in the past decade. Key milestones, such as the introduction of the CUDA programming model and advancements in ray tracing technology, have solidified Nvidia’s dominance in the GPU market. The company’s strategic investments in AI technologies have further positioned it as a key resource in the evolving tech landscape, impacting sectors that range from gaming to complex scientific research.

Nvidia’s innovative trajectory is underscored by notable collaborations and acquisitions, which have expanded its capabilities and market reach. The acquisition of Mellanox Technologies in 2020, for instance, enhanced Nvidia’s data center business and allowed it to broaden its portfolio of high-performance computing solutions. This decisive move illustrates the company’s commitment to steering its growth through technology alignment and market demand. As a result, Nvidia continues to capture significant market share, resulting in impressive financial performance and positioning within the semiconductor ecosystem.

This overview sets the context for a deeper analysis of Nvidia’s stock price chart, where we will explore the trends and insights that have influenced its market valuation over the years.

Understanding the Nvidia stock price chart: Key Metrics and Indicators

The analysis of Nvidia’s stock price chart is essential for investors seeking to make informed decisions. Several key metrics and indicators can provide valuable insights. Firstly, the price-to-earnings (P/E) ratio is a critical metric. This ratio helps investors understand the valuation of Nvidia’s stock relative to its earnings. A higher P/E may indicate that the stock is overvalued, or alternatively, it may reflect strong market confidence in future growth.

Another important element is the market capitalization, which provides a comprehensive view of Nvidia’s total value as a publicly traded entity. By multiplying the current stock price by the total number of outstanding shares, market capitalization facilitates comparison with competitors and identifies Nvidia’s position within the technology sector.

Moreover, trading volume is a crucial indicator that shows the number of shares traded within a specific timeframe. Increased trading volume often signals heightened investor interest, which can impact stock price movements. For instance, abnormal spikes in trading volume may indicate that significant news has prompted a re-evaluation of the stock, making it a notable point of analysis.

In addition to fundamental metrics, technical indicators play a significant role in stock analysis. The moving averages smooth out price data over a specific period, thereby helping to identify trends. A common strategy involves observing the crossover of short-term and long-term moving averages to signal potential buy or sell opportunities.

The Relative Strength Index (RSI) is another technical indicator that measures the speed and change of price movements, typically ranging from 0 to 100. An RSI above 70 suggests that the stock may be overbought, whereas an RSI below 30 indicates it may be oversold, giving investors insight into potential entry or exit points. Lastly, the Moving Average Convergence Divergence (MACD) helps determine momentum and trend direction, offering further guidance on possible trading actions.

Historical Trends in Nvidia stock price chart: A Detailed Analysis

Nvidia Corporation, a leader in graphical processing units (GPUs) and artificial intelligence technology, has undergone significant fluctuations in its stock price since its initial public offering in 1999. Analyzing the historical trends of Nvidia’s stock reveals the influence of various factors, including product innovations, earning performance, and broader market dynamics.

In the early years, Nvidia’s stock price was relatively stable, with modest gains resulting from steady product releases aimed at both consumers and professionals. However, a notable transformation occurred in the mid-2010s when demand surged due to the rise of gaming and cryptocurrency mining. This phenomenon contributed to a sharp increase in Nvidia’s stock as the company capitalized on its industry-leading technology, leading to a peak market valuation.

Key product launches have played a critical role in shaping the stock price trajectory. The introduction of the Pascal architecture in 2016 marked a milestone, significantly enhancing performance and driving sales across various segments. Subsequent releases, like the Turing architecture, captured market attention, further propelling stock prices. Additionally, Nvidia’s strategic moves into artificial intelligence and data centers have highlighted its adaptability and potential for long-term growth, positively influencing investor sentiment.

Earnings reports have also been crucial in affecting Nvidia’s stock trends, often resulting in volatility. For instance, in Q2 2021, robust earnings and optimistic guidance led to an unprecedented spike in stock prices. Conversely, unexpected results or cautious forecasts can lead to rapid declines. Furthermore, external factors, such as shifts in market sentiment and economic conditions, have driven fluctuations, illustrating the stock’s volatility.

Overall, Nvidia’s stock history presents a compelling case study of how innovation, market trends, and external factors converge to drive performance, underscoring the importance of comprehensive analysis for investors looking to engage with this dynamic stock.

Future Outlook for Nvidia’s Stock: Analyst Predictions and Market Sentiment

The future outlook for Nvidia’s stock appears to be influenced by multiple factors, including technological advancements, competitive pressures, and macroeconomic conditions. Analysts have been bullish on Nvidia’s capacity to harness growth in areas such as artificial intelligence (AI) and gaming, which are pivotal to its growth strategy. With AI applications gaining traction across industries, Nvidia’s GPUs play a critical role, propelling expectations for expansive revenue streams. According to several analysts, this strong growth avenue could significantly bolster Nvidia’s stock price in the coming quarters.

Moreover, advancements in gaming technology, particularly with the emergence of next-generation consoles and graphics performance enhancements, position Nvidia as a leading player in this segment. The company’s commitment to innovation and its continued development of cutting-edge graphics cards could resonate positively with investors, reinforcing confidence in the stock’s potential. Analysts forecast a favorable trajectory if Nvidia maintains its competitive edge and expands its market share in the gaming industry.

However, potential challenges exist that could affect stock performance. Increased competition from companies like AMD and Intel presents a dynamic environment that may pressure Nvidia’s pricing strategies, potentially affecting margins. Additionally, the volatility surrounding semiconductor supply chains and geopolitical tensions adds a layer of uncertainty that analysts are closely monitoring. Recent headlines regarding tech regulations and trade relations can also cultivate caution among investors.

Market sentiment has shown resilience, with investors largely optimistic about Nvidia’s future proving evident from recent trading patterns. Overall, while the outlook for Nvidia’s stock remains promising with robust opportunities in AI and gaming, stakeholders should stay vigilant regarding market dynamics and competitive factors that might influence performance. As both analysts’ predictions and market sentiment evolve, a comprehensive analysis is essential for those evaluating Nvidia’s stock potential moving forward.

-

Finance2 months ago

Finance2 months agoThe Importance of Business Card Holders: A Comprehensive Guide

-

Finance2 months ago

Finance2 months agoUnderstanding Apple Business Manager: A Comprehensive Guide

-

Finance2 months ago

Finance2 months agoUnderstanding the Business for Sale Market: A Comprehensive Guide

-

Finance2 months ago

Finance2 months agoThe Evolution of Office Depot Business: A Comprehensive Overview

-

Online Games Platform2 months ago

Online Games Platform2 months agoExploring the World of Go Game Online: A Comprehensive Guide

-

Online Games Platform2 months ago

Online Games Platform2 months agoThe World’s Hardest Game: An In-Depth Analysis

-

Finance2 months ago

Finance2 months agoThe Whiskey Business: An In-Depth Exploration of a Timeless Industry

-

Finance2 months ago

Finance2 months agoGeorgia Business Search: A Comprehensive Guide